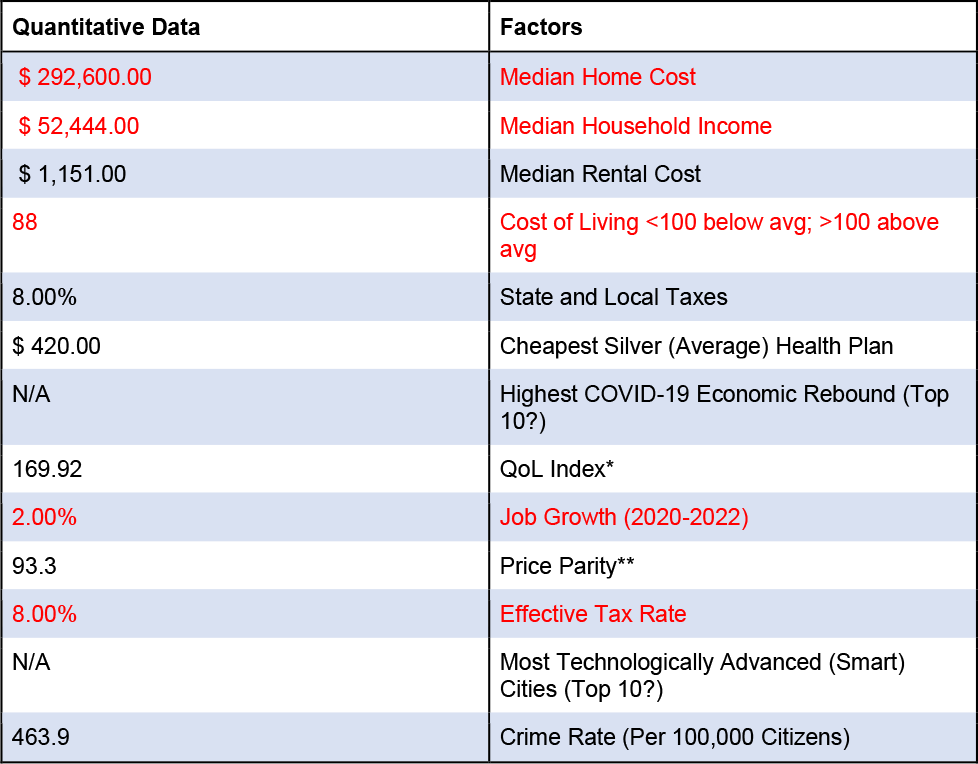

san antonio sales tax rate

There are approximately 3897 people living in the San Antonio area. Does Texas have sales tax.

10 Things To Know Before Moving To San Antonio Tx

Recommendation letter university sample.

. This includes the rates on the state county city and special levels. The Texas state sales and use tax rate is 625 percent but local taxing jurisdictions cities counties special. Remember that zip code boundaries.

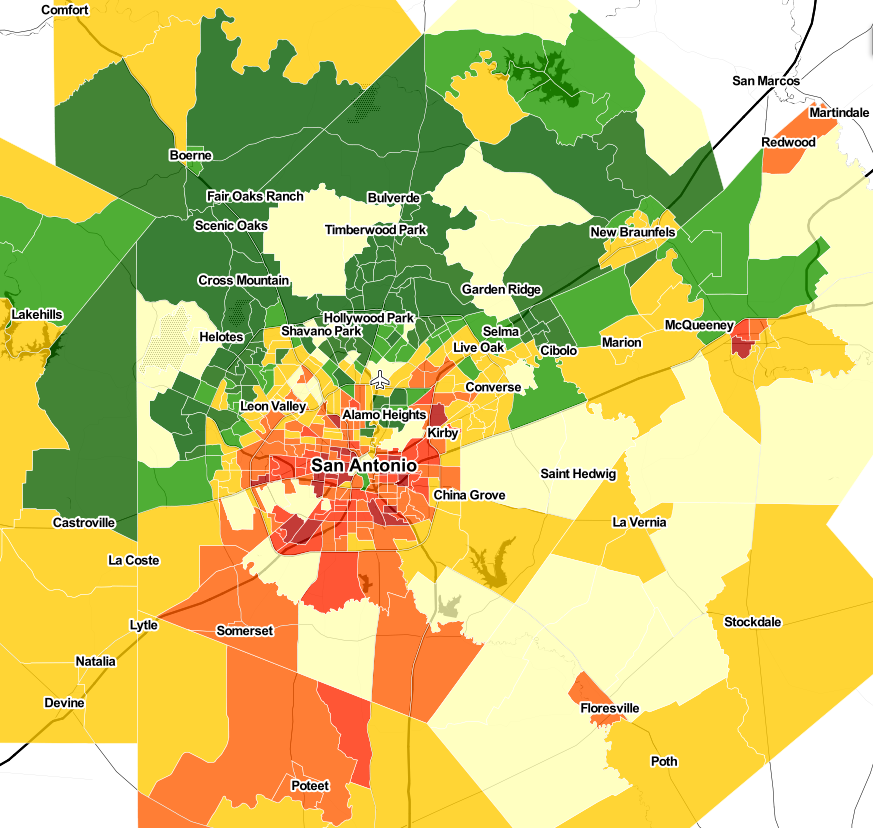

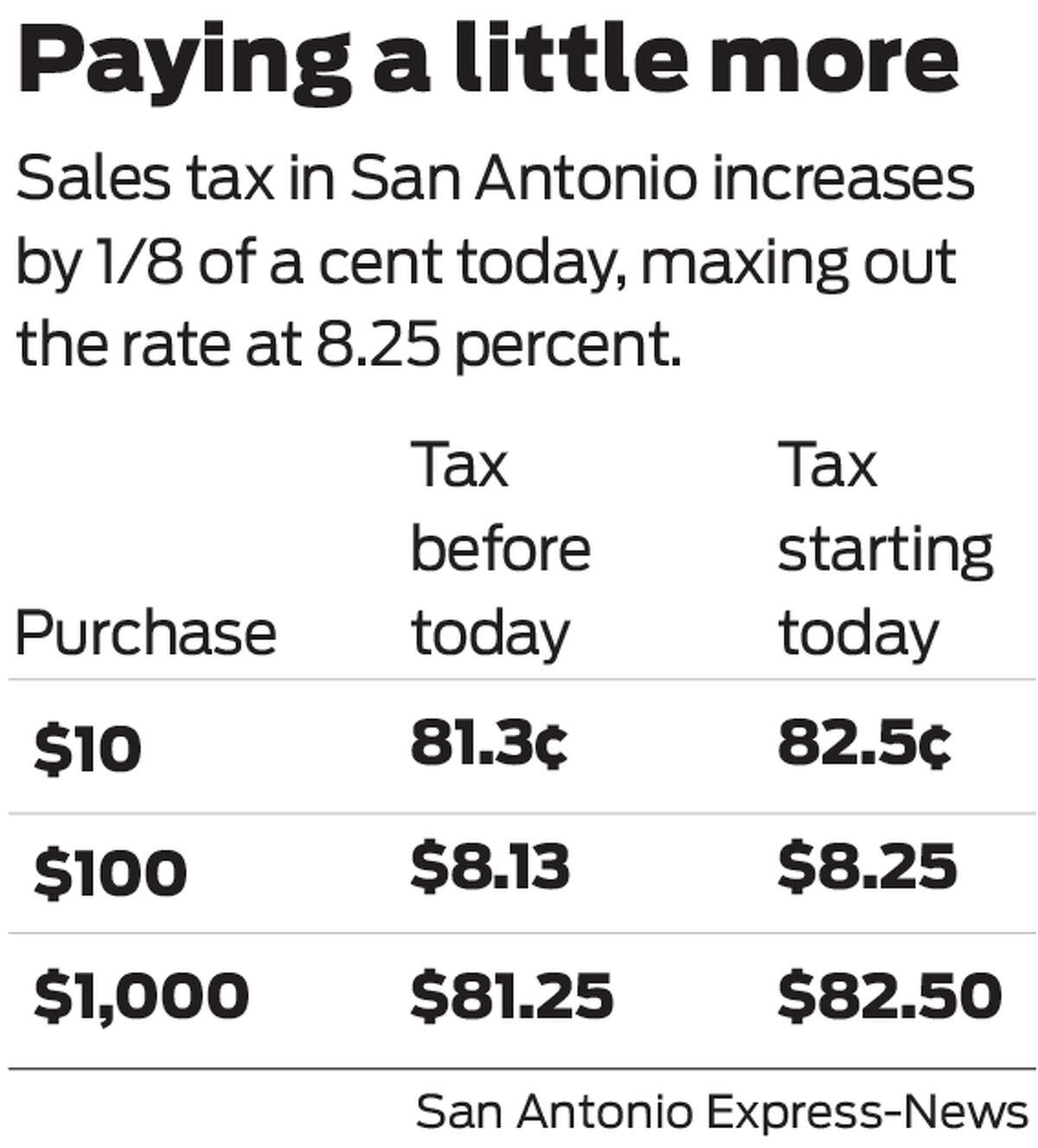

What is Texass tax rate. The December 2020 total local sales tax rate was also 63750. The 78216 San Antonio Texas general sales tax rate is 825.

Object moved to here. The combined rate used in this calculator 825 is the result of the Texas state rate 625 the San Antonio tax. The property tax rate for the City of San Antonio consists of two components.

The San Antonio Florida sales tax rate of 7 applies in the zip code 33576. The San Antonio sales tax rate is 825. The San Antonio Texas sales tax is 625 the same as the Texas state sales tax.

2015 stingray boat price fresco play node js hands on answers. The taxable value of private-party purchases of used motor vehicles may be based on the standard presumptive value. Maintenance Operations MO and Debt Service.

This is the total of state county and city sales tax rates. While many other states allow counties and other localities. The San Antonio Sales Tax is collected by the merchant on all qualifying sales made within San Antonio.

The minimum combined 2022 sales tax rate for San Antonio Florida is. San Antonio has parts of it located within Bexar. The latest sales tax rate for San Antonio TX.

Download all Texas sales tax rates by zip code. This rate includes any state county city and local sales taxes. 2022-7-30 Nearby homes similar to 2604 San Antonio Dr have recently sold between.

The Fiscal Year FY 2023 MO tax rate is 33011 cents. The minimum combined 2022 sales tax rate for San Antonio Texas is. This is the total of state and county sales tax rates.

The sales tax jurisdiction. The San Antonio sales tax rate is 825. What is the sales tax rate in San Antonio Texas.

The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax. 2020 rates included for use while preparing your income tax. The local sales and use tax rate history shows the current and prior sales tax rates imposed by a local jurisdiction along with the effective date and end date of each tax.

The Texas state sales and use tax rate is 625 percent but local taxing jurisdictions cities counties special. The Texas state sales tax rate is currently. The Bexar County sales tax rate is 0 however the San Antonio MTA and ATD sales tax rates are 05 and 025 respectively meaning that the minimum sales tax you will have to pay in.

The San Antonio Mta Texas sales tax is 675 consisting of 625 Texas state sales tax and 050 San Antonio Mta local sales taxesThe local sales tax consists of a 050 special. The average cumulative sales tax rate in San Antonio Texas is 822. Texas residents 625 percent of sales price less credit for.

The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax. The minimum combined 2022 sales tax rate for Bexar County Texas is. What is Texass tax rate.

What is the sales tax rate in San Antonio Florida. The current total local sales tax rate in San Antonio NM is 63750. This is the total of state county and city sales tax rates.

The sales tax jurisdiction. There is no applicable county tax. The 825 sales tax rate in San Antonio consists of 625 Puerto Rico state sales tax 125 San Antonio tax and 075 Special taxThere is no applicable county tax.

San Antonio Could Roll Back Its City Property Tax Rate Due To Higher Projected Revenues Tpr

Notice About 2021 Tax Rates Post City Of Grey Forest

Understanding California S Sales Tax

Plano Commits Not To Raise Property Tax Rate As City Faces Tight Budget Season Community Impact

Understanding California S Sales Tax

What Is The San Antonio Sales Tax Rate The Base Rate In Texas Is 6 25

Top 10 Cities For Financial Independence In 2022 Choosefi

Property Taxes Sugar Land Tx Official Website

Texas Sales Tax Rate Changes January 2019

Why Are Property Taxes So High In Texas Here Are 3 Reasons

The Most Tax Friendly States To Retire

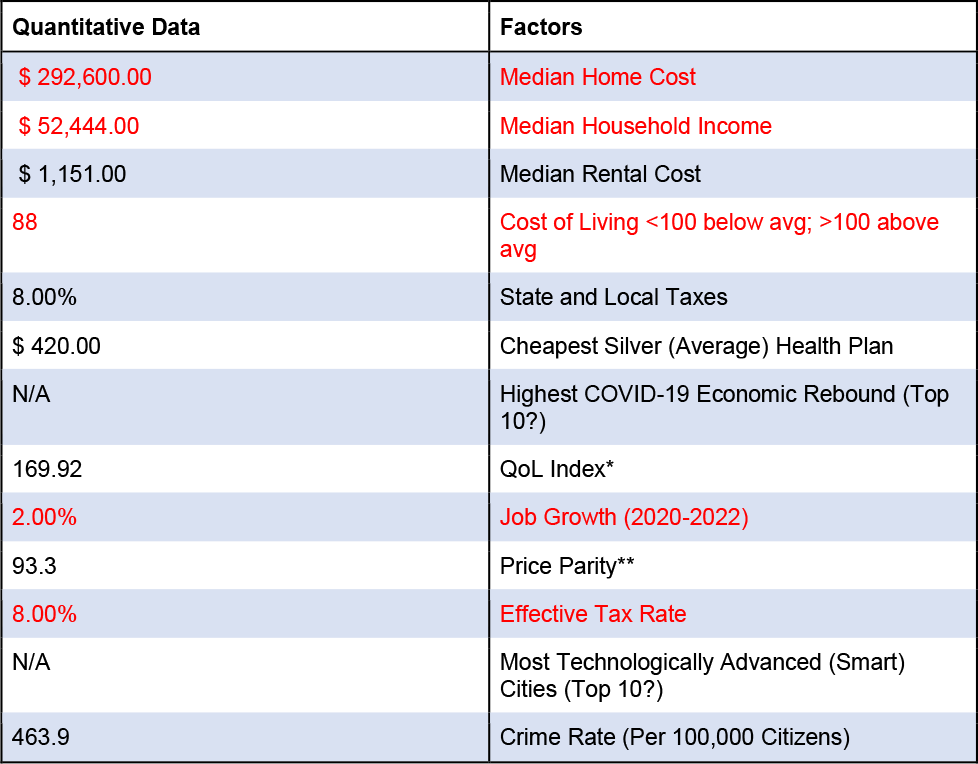

San Antonio Real Estate Market Stats Trends For 2022

Sales Tax Increase To Fund Pre K 4 Sa Starts Today

Texas Tax Free Shopping Weekends 2022 2022

Texas Sales Tax Guide For Businesses

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

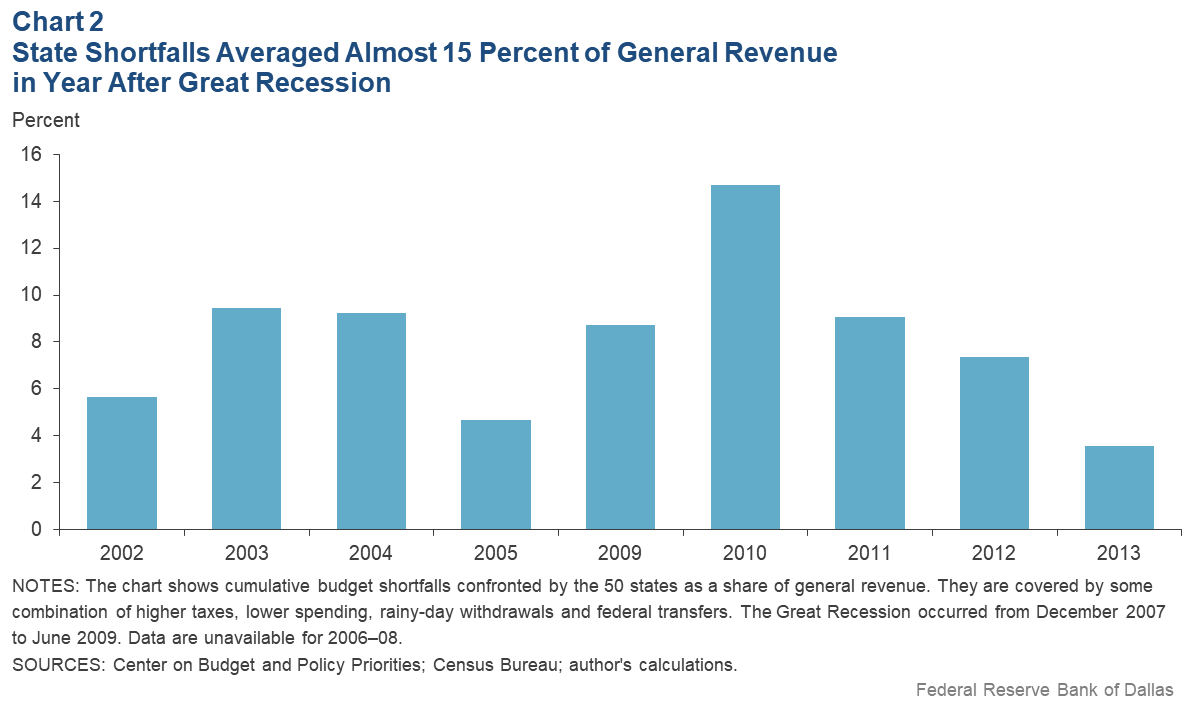

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org